Start with a solid methodology

After an insurance event it can appear sensible to pass over the responsibility to assess damage to your home to your insurer, EQC, or even your local builder. However, the experience of many Canterbury homeowners has proven it can quickly become a complex, heartbreaking, expensive and messy process when it goes wrong. The lesson learnt – keep a healthy degree of independence when you are being paid the cash equivalent to reinstate damage reduces homeowner risk (plus it is generally your obligation, under most insurance policies, and the EQC Act, to prove loss after an insurance event), and form a solid team of expertise around you. Your risk can be well managed, and homes can be reinstated to the correct standard – resulting in great good outcomes for current homeowners and impacted communities.

Best practice is vital

A range of knowledge and skill is required to reinstate disaster damaged homes if the homeowner intention is to conform to the insurance entitlement and do the work. If that is you, you need a team of experts. Each team member will be called on at the right time, each needs to be conservative and best practice driven. Construction skill, structural and geo-technical expertise, cladding and drainage specialists, foundation experts all working to insurance principles, each presenting facts correctly and coherently, each staying in their lane, removing as much of their personal bias as possible. Best practice means a team prepared to make the hard calls. A team prepared to tell you or your insurer the truth. A team capable of calling on knowledge of entitlements and reinstatement standards, policy and legislation, risk management and construction is critical for both homeowners and insurers when the work is being done.

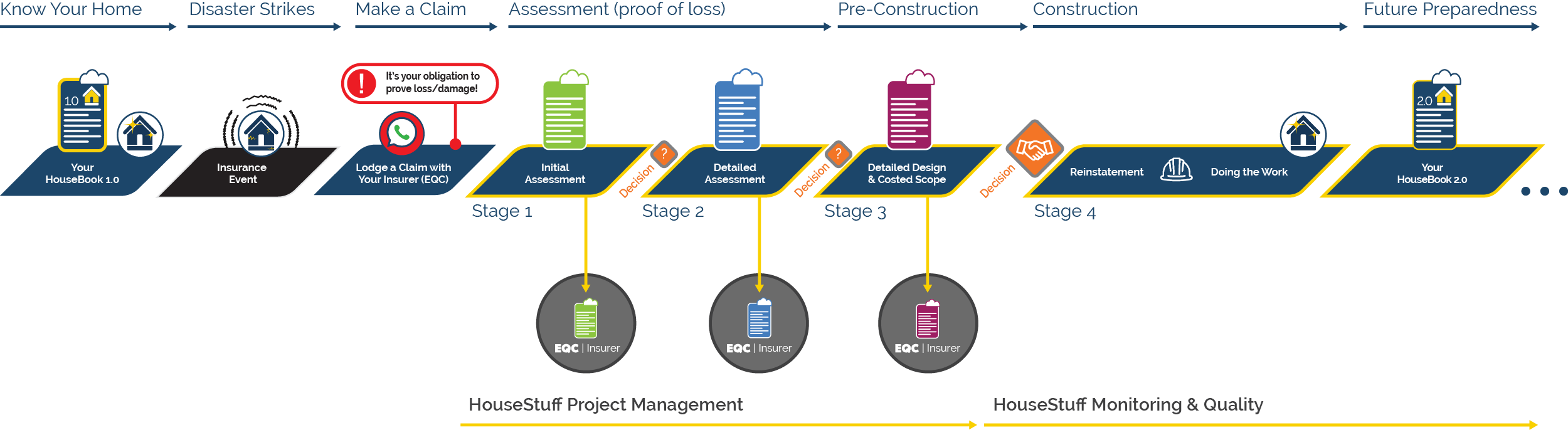

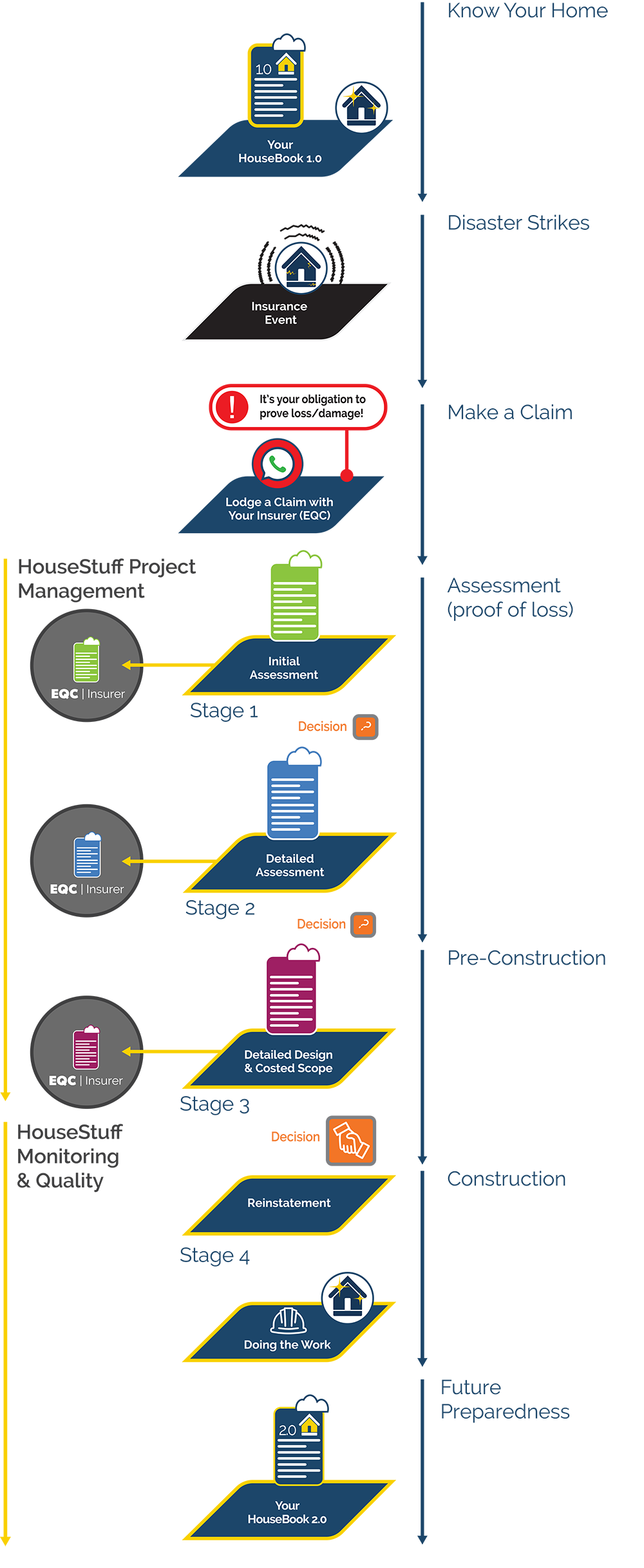

It is a step by step process

At the highest level break our process into Key Steps, for example, “Know Your Home”, “Disaster Strikes”, “Make a Claim”, “Assessment”, and so on. After a claim has been made there are four stages in the methodology we know you must follow if you intend to reinstate your home when you are being paid the cash equivalent to reinstate. We break each stage down into a detailed range of tasks, inclusive of consultation milestones with your insurer/EQC and insurance advisor as required. In our process, before you move from one stage to the next, decisions must be made and agreements reached with the insurer, your team of experts and insurance advisor.

We recommend a consultative approach to working with EQC and/or your insurer whenever possible. However, when they are the ones paying you the cash equivalent to reinstate your home, and you seriously intend to have the work done to the insurance standard, we do not recommend you rely on reports or assessments commissioned by the insurer for the insurer, or by a builder for the builder, nor any party other than yourself.

You must ensure you complete due diligence about each team member you select, and they all must all know you are ‘doing the work’ so they can each consider their liability to you and your project. Yes, to do it once and do it right takes time and often some investment, but doing it once and right is always worth it.

The process laid out

From proving loss to good as new

Disaster Strikes

With quality-pre-disaster-data you are well prepared to get your home back as good as new.The Worst Has Happened

All going well you have your really good data about your home, stored with us, good routines were followed, great technology used, and historical data has traveled with your home from previous owners to you. If you don’t have quality-pre-disaster data we work with what we can gather to being navigate the processes you need to follow to reinstate your home correctly and well. Regardless, now it has happened, lodge your claim, now STOP, and let’s get on with Stage One: Initial Assessment.

1. Initial Assessment

Invest in your own initial damage assessments rather than fully relying on an insurer to do this for you - it is your responsibility after all.Determine the Damage

If you get this stage right you are on the right pathway and have more confidence about what has happened to your home and what comes next. At this early stage we begin to connect you with information about best insurance and construction process, often a little about entitlements and reinstatement standard/s. This is because to us it is important to us you establish personal knowledge base about the process, so you are better positioned to make informed decisions.

2. Detailed Assessment

Based on the findings from the initial assessment a range of other assessment may be necessary to ensure all damage is correctly understood.Deep Dive Facts About Your Home

Detailed assessment processes are not limited to, and nor do they solely pivot on, structural engineering. It is likely, after a significant insurance event you need a team of experts to ensure damage and any enabling work is correctly determined prior to your reinstatement strategy being agreed and costed. Your choice of professionals can make a significant difference. If you get it right at this stage it can reduce significant issues for you later.

3. Scope and Price

Reinstatement strategies must reflect insurance entitlements. Cost is not the barrier to a correct reinstatement strategy.Know the Cost and the Full Scope

To correctly reinstate your home you need a team of professionals and practitioners to participate in the scope and pricing exercise. For example, quantity surveyors, builders, lawyers, subject matter experts, and as appropriate a structural and geo-technical engineers, and often an architect. Your insurer’s claim specialist has an important role to play too, and must be included in the process at the right time.

4. Reinstating Your Home

Whether the reinstatement means repairing or rebuilding your home, to us, it is done with you involved, in full consultation with your team.Doing the Work

This is when the work happens, and you are central to your project – it is your home. We want you to visit site. We want you to meet with your team regularly. We want you to ask questions. To reconnect with your home after a disaster it is important you be involved as your home is reinstated to as good (often even better) as new. Our job is to quality manage your team and the process throughout, compiling the data for your HouseBook.